Four key challenges for CSPs competing in the commercial and enterprise telecom service market

However

Understanding real day-to-day issues

Working with numerous global tier one CSPs we hear about the real, day-to-day issues that put both sales forecasts and

- Marginal opportunity win rates

- Slow customer response times

- Problems with installation and service delivery

- Low or decreasing NPS

We’ve observed a number of factors that underpin these four main offenders. For example, when technical sales and sales support teams don’t have access to accurate, up to date network information. This can include the location footprint, on net/off net buildings and addresses, available capacity, planned expansion projects, and service request history. Without this vital detail they cannot respond in real-time or even quickly.

It can take days to research the necessary information and ask for help from engineering, and the problem is further complicated because the data they can access is incomplete and frequently inaccurate. Commercial and enterprise customers looking for the latest telecom connectivity and technology offerings have choices, so any delay in getting the information they need, such as a detailed quote and an ETA on installation, could see them move to a competitor.

Empower users to self-serve

Providing network information to a wider audience of sales executives, account managers, technical sales, and customer support teams through geospatial inventory integration with CRM empowers these users to be able to self-serve. This promotes real-time engagement when dealing with either existing (upsell) or potential (new service) customer enquiries.

Taking this approach, we’ve seen service providers drive higher win rates, accelerate response times, improve data accuracy and dramatically reduce the dependency and number of requests to the engineering teams.

As an example, at one leading global business connectivity provider, we’ve seen marked elimination of sales requests into engineering for serviceability information which has two downstream

Win rates were shown to improve with informed real-time engagement and engineering team productivity went up by as much as 40% when not being inundated with sales RFIs.

Unlock the power of geospatial network data through CRM integration

Now let’s look at the overall approach and specific use cases when making this work in practice. When looking to unlock the power of geospatial network data through CRM integration, we see three key requirements:

- Smart – integration with the CRM should be tight. Customer records should be shown in the map view alongside the network data.

- Simple – it must be easy to use and provide targeted, intuitive functionality; for example, Google

basemaps and Streetview are familiar to all and provide context. - Fast – CRM users are busy people; they need access to information quickly with minimal load times.

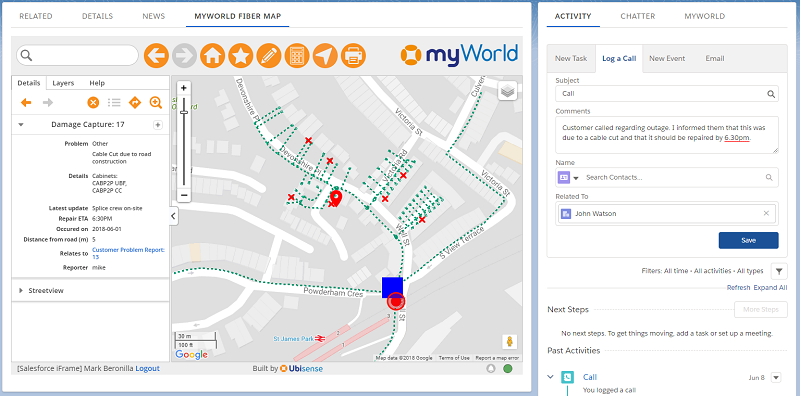

Figure 1: Smart, simple and fast is key when developing an integrated CRM/network data solution

Understanding the needs of the sales team, operations and customer service

When designing an integrated solution, understanding the needs of the end user is key. Below are three scenarios we have seen across our user base:

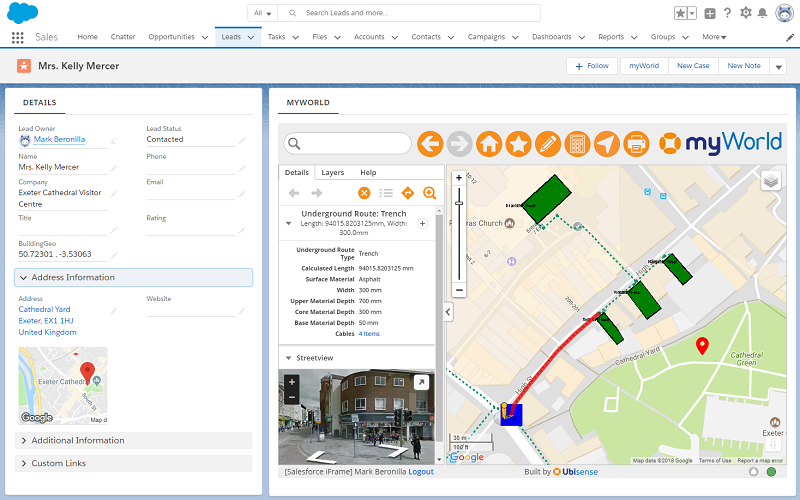

1. Existing customer sales enquiry – a sales person is meeting with an existing customer. They express interest in upgrading their fibre service. The sales person can find the customer record to see their current service package. By using the network component, they can then look directly at the network data to see whether there is capacity to easily upgrade the service or whether additional network infrastructure would be required. They can then provide this information immediately to the customer without the need to follow-up with engineering first.

Figure 2: Clicking on a feature provides valuable information to a CRM user

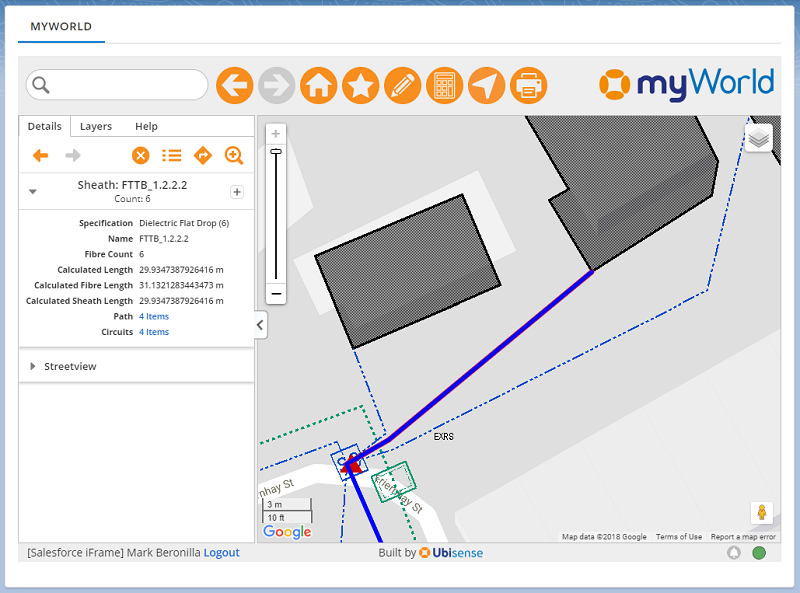

2. New customer sales enquiry – a call centre employee receives a call from a potential customer. They wish to have fibre connectivity for their organisation. The CRM user can quickly log the prospect information and, once they have entered an address, can see the network infrastructure currently in the vicinity. By clicking on nearby cabinets to get current capacity information, the employee can quickly trace a potential route to serve the new customer.

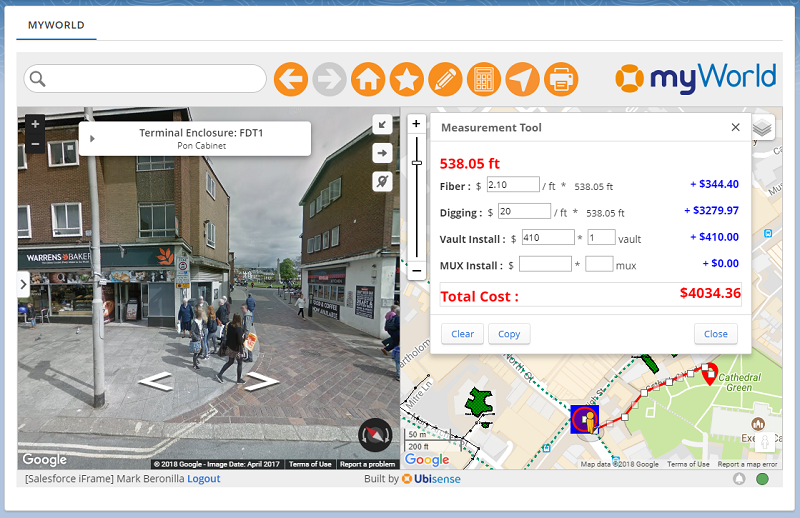

Using Streetview, they can further validate the potential route and understand the types of surface that would need to be dug up and estimate the associated installation costs. A calculation tool can be used for this purpose so that the customer can be informed immediately be given an initial estimate and the opportunity can quickly be progressed.

Figure 3: Targeted tools such as a cost calculator empower CRM users to deal with enquiries in real time

3. Existing customer issue troubleshooting– a customer service representative receives a call from a customer who is without service. After finding the customer’s account, the CRM user can use the network component to see whether there are other customers in the area that have reported issues. Furthermore, they can also view trouble ticket information and associated notes to give the caller information about the issue and provide an estimated remediation time. Finishing up they can log the call, having been able to handle the entire call in a single screen, without the need to involve engineering.

Figure 4: Leveraging trouble tickets and other operational data allows customer queries to quickly be dealt with

Improve commercial business and enterprise customer NPS and increase win rates

We’ve helped CSPs overcome some of their biggest sales and service challenges including delays in customer response times; large volumes of requests to engineering; and marginal NPS ratings. By bringing critical network-centric information into the CRM workflow, a new level of speed and agility can be realised, which drives greater win rates and

Unlock the power of your network inventory data

To find out more and understand how you can unlock the power of your network inventory data, view the IQGeo for Salesforce overview page.

myWorld is now the IQGeo Platform

The 6.0 release of our software included a product name change from myWorld to the IQGeo Platform. This change reflects our focus on the IQGeo corporate brand that was launched at the beginning of 2019. Our website and latest product user interface have made the transition from the old myWorld name to the new IQGeo Platform name. Learn more about the IQGeo Platform 6.0 release.

Principal Solution Architect at IQGeo

Similar articles:

Previous

Previous